BUSINESS CREDIT & FUNDING PLATFORM

BUSINESS CREDIBILITY

STEP 1.10 – WRAP UP

PROGRAM MENU

➡ MODULE 1 - BUSINESS CREDIBILITY

• Step 1.1 Business Name

• Step 1.2 Business Address

• Step 1.3 Business Entity

• Step 1.4 EIN#

• Step 1.5 Business Phone # & 411

• Step 1.6 Business Website & Email

• Step 1.7 Business Licence

• Step 1.8 Business Bank Account

• Step 1.9 Business Merchant Account

• Step 1.10 Wrap Up

➡ MODULE 2 – ESTABLISH BUSINESS REPORT

• Step 2.1 Dun & Bradstreet

• Step 2.2 Experian Business

• Step 2.3 Equifax Business

• Step 2.4 Reporting- How to Fix Business Credit

➡ MODULE 3 – START BUILDING: TIER 1

• Step 3.1 Start Building: Tier 1

➡ MODULE 4 – BUSINESS REPORT MONITORING

• Step 4.1 Credit Monitoring

• Step 4.2 Monitor Dun & Bradstreet

• Step 4.3 Monitor Experian Business

• Step 4.4 Monitor Equifax Business

• Step 4.5 Request Lexis Nexis report

• Step 4.6 Request Chex Systems Report

➡ MODULE 5- BUILDING CREDIT: TIER2

• Step 5.1 Building Credit: Tier2

➡ MODULE 6 – ADVANCED BUILDING: TIER 3

• Step 6.1 Advanced Building: Tier 3

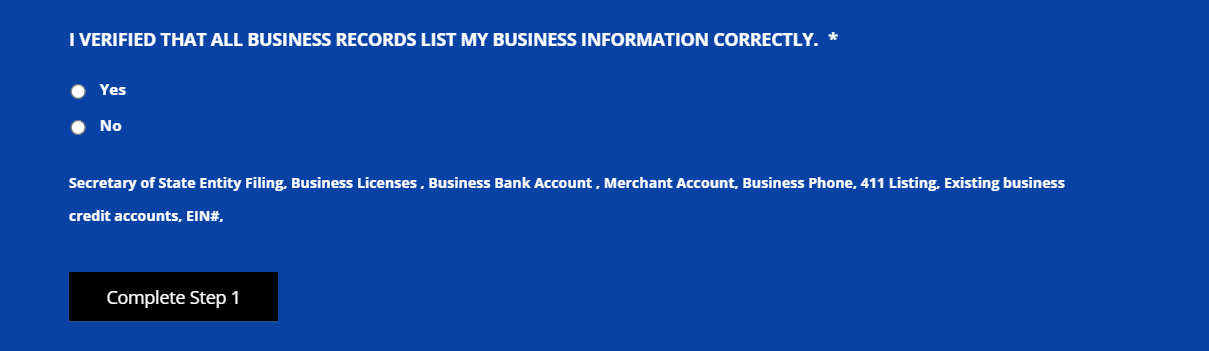

DO ALL BUSINESS RECORDS LIST THE CORRECT BUSINESS NAME, ADDRESS, OWNERSHIP AND CONTACT INFORMATION?

VIDEO TRANSCRIPT

Step 1 Wrap Up

One of the most important parts to establishing your business credibility is making sure ALL your business records list the same business information.

Lenders verify these details during the underwriting process. Mismatched records are one of the most common reasons a fundable deal is declined.

To move forward, please verify the following business records:

Secretary of State Entity Filing

Business License

EIN#

Business Bank Account

Merchant Account

Current Business Credit Accounts

411 Listing

Website

ALL business records should list 100% correct business information

Any business creditors that list incorrect information should be updated.

It’s a simple key to success.

Verify all your business records today.