BUSINESS CREDIT & FUNDING PLATFORM

Establish Business Reports

STEP 2.2 – EXPERIAN BUSINESS

PROGRAM MENU

➡ MODULE 1 - BUSINESS CREDIBILITY

• Step 1.1 Business Name

• Step 1.2 Business Address

• Step 1.3 Business Entity

• Step 1.4 EIN#

• Step 1.5 Business Phone # & 411

• Step 1.6 Business Website & Email

• Step 1.7 Business Licence

• Step 1.8 Business Bank Account

• Step 1.9 Business Merchant Account

• Step 1.10 Wrap Up

➡ MODULE 2 – ESTABLISH BUSINESS REPORT

• Step 2.1 Dun & Bradstreet

• Step 2.2 Experian Business

• Step 2.3 Equifax Business

• Step 2.4 Reporting- How to Fix Business Credit

➡ MODULE 3 – START BUILDING: TIER 1

• Step 3.1 Start Building: Tier 1

➡ MODULE 4 – BUSINESS REPORT MONITORING

• Step 4.1 Credit Monitoring

• Step 4.2 Monitor Dun & Bradstreet

• Step 4.3 Monitor Experian Business

• Step 4.4 Monitor Equifax Business

• Step 4.5 Request Lexis Nexis report

• Step 4.6 Request Chex Systems Report

➡ MODULE 5- BUILDING CREDIT: TIER2

• Step 5.1 Building Credit: Tier2

➡ MODULE 6 – ADVANCED BUILDING: TIER 3

• Step 6.1 Advanced Building: Tier 3

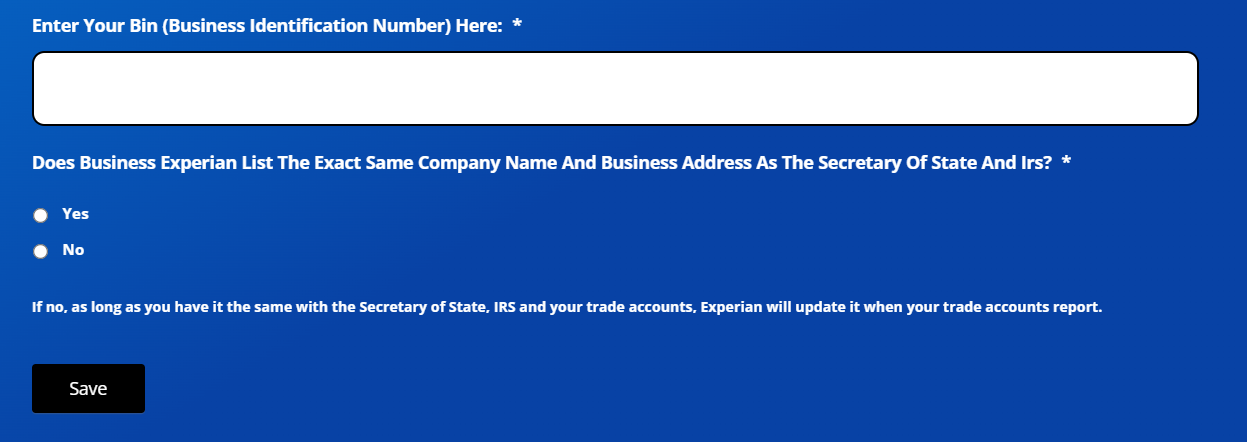

DOES YOUR BUSINESS HAVE A PROFILE WITH BUSINESS EXPERIAN YET?

Goal for Step 2.2 is to see if your company is listed with Experian yet and to see if any discrepancies which can be fixed by the directions in Step 2.4

If your answer is Yes to this question than great job having your company already known by Business Experian we are excited to help you continue building your profile with them. If you aren’t sure if you do or not, no need to worry you can scroll for directions on what to do.

SEARCH TO SEE IF YOUR BUSINESS HAS A BUSINESS EXPERIAN REPORT

If you are unsure no need to worry, use the below link to see if your company has a profile with Business Experian. No need to purchase monitoring now, we will guide you in setting up monitoring in Step 4. If your company isn’t listed, no need to sweat this it will be created as you get business credit accounts in Step 3/Tier 1.

RESOURCES

We hope you love the products and services we recommend! We research and update these on a regular basis. Just so you know, we may receive a commission from links on this page. We are diligent to ensure any compensation we receive does not affect the price or level of service offered to you.

COST: Monthly Fee

THE CONTENT OF THIS RESOURCES SECTION IS RESTRICTED.

PLEASE SIGN UP TO GET ACCESS!!

VIDEO TRANSCRIPT

Establishing Business Experian

Business Experian is one of the major business credit reporting agencies

How do you establish your business Experian credit report? Your business Experian report is created automatically as your business creditors report.

- Apply for business credit

Make sure you select creditors that report to business Experian. Most business creditors check business credit but many don’t report payment history to build your business credit report

- Make a purchase

Use your new or existing business credit account by making a purchase.

- Pay your bill

Once your invoice or bill is generated it is time to make a payment. It is this payment on your business credit account that is reported to the business credit bureau.

Let’s break this down further.

When applying for business credit with lenders it is important that you select lenders that report to Business Experian. Most lenders do check business credit but most lenders don’t report payment history back to all 3 business credit bureaus. Some creditors only report negative payment history.

Once you have verified that the creditor does report positive payment history it is time to apply for the business credit.

Make sure you fill out the application using correct business information, the same information that is listed on your business records. Creditors will go through an approval process where they verify the supplied information on the application with your business records and / or your existing business credit reports.

Sometimes a creditor doesn’t approve the first time. Remember to follow up with the creditor to find out why the business wasn’t approved. Sometimes a phone call and manual review will turn a decline into an approval. The initial response is typically generated from an automated underwriting process.

Once your account is approved its time to make a purchase using your new business credit account. Keep in mind that you must use the credit account in order to build business credit history. It is the payment that is reported.

After you have made your purchase wait for your invoice or bill to be generated. If you make a payment too soon the creditor may not report the payment because it came in before the credit terms were utilized.

It is important that you pay your bill on time. Late payments can be reported to your business credit report and have a large impact on the credibility of the company.

The creditor typically takes 1 billing cycle (or 30 days) to report your payment to the business credit bureau. The business credit agency then takes up to 30 days to match the received payment history to your specific business credit report. This means it could take around 60 days for your payment experience to show on your business credit report.

Once your business credit history is established with a creditor we recommend applying for increases within their recommended time frame. Some lenders will only let you apply for an increase every 6months. Others as soon as 3 months and some as long as 1 year. Applying for increases builds your business credit history further. Lenders tend to mimic the highest approval amount reported, as you move that needle up you can expect higher approval limits in the future.

APPLY FOR A D&B NUMBER

Click HERE

D&B BASIC REPORT INFORMATION