BUSINESS CREDIT & FUNDING PLATFORM

Business Report Monitoring

STEP 4.5 – REQUEST LEXIS NEXIS REPORT

PROGRAM MENU

➡ MODULE 1 - BUSINESS CREDIBILITY

• Step 1.1 Business Name

• Step 1.2 Business Address

• Step 1.3 Business Entity

• Step 1.4 EIN#

• Step 1.5 Business Phone # & 411

• Step 1.6 Business Website & Email

• Step 1.7 Business Licence

• Step 1.8 Business Bank Account

• Step 1.9 Business Merchant Account

• Step 1.10 Wrap Up

➡ MODULE 2 – ESTABLISH BUSINESS REPORT

• Step 2.1 Dun & Bradstreet

• Step 2.2 Experian Business

• Step 2.3 Equifax Business

• Step 2.4 Reporting- How to Fix Business Credit

➡ MODULE 3 – START BUILDING: TIER 1

• Step 3.1 Start Building: Tier 1

➡ MODULE 4 – BUSINESS REPORT MONITORING

• Step 4.1 Credit Monitoring

• Step 4.2 Monitor Dun & Bradstreet

• Step 4.3 Monitor Experian Business

• Step 4.4 Monitor Equifax Business

• Step 4.5 Request Lexis Nexis report

• Step 4.6 Request Chex Systems Report

➡ MODULE 5- BUILDING CREDIT: TIER2

• Step 5.1 Building Credit: Tier2

➡ MODULE 6 – ADVANCED BUILDING: TIER 3

• Step 6.1 Advanced Building: Tier 3

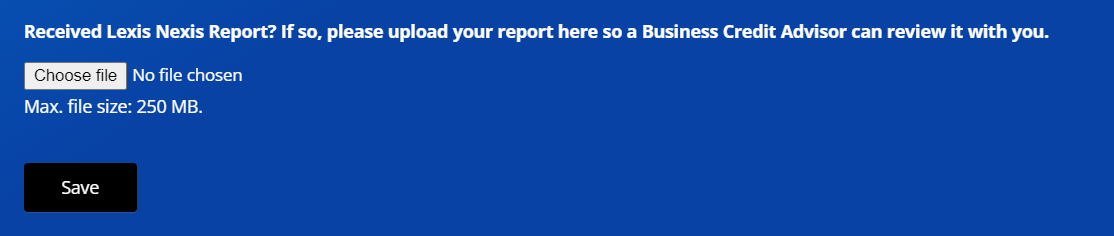

REQUEST LEXIS NEXIS REPORT

REQUEST LEXIS NEXIS REPORT

LexisNexis provides business research and risk management services to various industries. These include lenders, insurance companies, vendors and more. These companies use LexisNexis to verify personal and business credit history, public records, and application history. And they use LexisNexis to assess risk on applicants. Inaccurate information, data which doesn’t match your application, or negative items in your LexisNexis report can have a drastic negative impact on your business. This is especially true during the application process.

We recommend all business owners request a copy of their LexisNexis report. Verify all data as an individual and on the business. We’ve made it simple with the link and instructions to request your LexisNexis report below.

Proactively address inaccuracies and decrease the probability of surprises during the application process.

Take control of your company’s fundability by requesting a copy of your LexisNexis report today.

If inaccurate information on your Lexis Nexis report please click the below link to follow their instructions to resolve the inaccuracy:

RESOURCES

We hope you love the products and services we recommend! We research and update these on a regular basis. Just so you know, we may receive a commission from links on this page. We are diligent to ensure any compensation we receive does not affect the price or level of service offered to you.

COST: Monthly Fee

THE CONTENT OF THIS RESOURCES SECTION IS RESTRICTED.

PLEASE SIGN UP TO GET ACCESS!!

VIDEO TRANSCRIPT

Get information most creditors use to verify you as an individual and your business by asking for a copy of your LexisNexis report.

LexisNexis provides business research and risk management services to various industries. These include lenders, insurance companies, vendors and more. These companies use LexisNexis to verify personal and business credit history, public records, and application history. And they use LexisNexis to assess risk on applicants. Inaccurate information, data which doesn’t match your application, or negative items in your LexisNexis report can have a drastic negative impact on your business. This is especially true during the application process.

We recommend all business owners request a copy of their LexisNexis report. Verify all data as an individual and on the business. We’ve made it simple with the link and instructions to request your LexisNexis report below.

Proactively address inaccuracies and decrease the probability of surprises during the application process.

Take control of your company’s fundability by requesting a copy of your LexisNexis report today.

MONITOR WITH NAV

Click HERE

BUSINESS EQUIFAX MONITORING